Ii A profit-sharing plan is a plan established and maintained by an employer to provide for the participation in his profits by his employees or their beneficiaries. The plan must provide a definite predetermined formula for allocating the contributions made to the plan among the participants and for distributing the funds accumulated under the plan after a fixed number of years the.

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Allow key employees to participate in the profits of the company b.

. A profit-sharing plan is a defined contribution pension plan in which the workers and employees are given an opportunity to obtain their share in the overall profit of the organization in such a way that they are encouraged to contribute more and more to the profit of the organization and motivates to give their best efforts thus it is an incentive plan that gives a variable benefit to. Qualified plans include 401k plans 403b plans profit-sharing plans and Keogh HR-10 plans. Of a joint and survivor annuity unless the spouse waived the right to a joint and survivor annuity or your plan is a profit-sharing plan that is exempt from the joint and survivor annuity requirements.

The joint and survivor requirements are designed to. N Can help attract and keep talented employees. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.

April 30 2017 was the last day to adopt a pre-approved defined contribution plan for plans adopted on or after January 1 2016. A profit-sharing plan gives employees a share in their companys profits based on its quarterly or annual earnings. Cash or Deferred Arrangement CODA Permits an employee to defer a portion of his salary on a pretax basis to a qualified plan or receive the salary as current taxable income.

A qualified profit sharing plan that uses a combination of age and compensation as the basis for allocating the contribution to a participants account cash or deferred arrangement CODA permits an employee to defer a portion of his salary on a pretax basis to a qualified plan or receive the salary as current taxable income. What is this called. The IRS issues an advisory letter to a VS practitioner if the VS plan document meets all.

The IRS issues an opinion letter to an MP plan sponsor if the plan document meets all legal requirements. This excludes plans that were adopted as a modification and restatement of a defined contribution pre-approved plan that had been maintained by the employer prior to January 1 2016. True False TrueA distribution from a qualified plan prior to age 59½ will be subject to income tax but will not be subject to the 10 penalty if the.

Profit sharing plan An employer has sponsored a qualified retirement plan for its employees where the employer will contribute money whenever a profit is realized. Dont confuse a defined benefit plan with another type of qualified retirement plan the defined contribution plan eg 401k plan profit-sharing plan. A qualified plan must satisfy the Internal Revenue Code in both form and operation.

A qualified profit sharing plan that uses a combination of age and compensation as the basis for allocating the contribution to a participants account. Upon surrender of a life insurance policy what portion of the cash value will be taxed. If a salary deferral feature is added to a profit-sharing plan it is a 401k plan Contribution limits The lesser of 100 of compensation or 61000 for 2022 58000 for 2021.

Profit sharing plans have additional advantages. Pre-approved plans are either Master and Prototype MP or Volume Submitter VS. A profit-sharing plan is a type of incentive plan where businesses give indirect or direct payments to employees.

Employers pool profits into a contribution fund which they distribute to all employees based on a pre-determined formula. What are the consequences of withdrawing funds from a traditional IRA prior to the age of 59 12. A qualified plan may have either a defined.

Keep key employees from leaving the company d. Employers start a profit sharing plan for additional reasons. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.

57000 for 2020 subject to cost-of-living adjustments for later years. And weve designed this material to serve simply as an informational and educational resource. As the name implies a defined benefit plan focuses on the ultimate benefits paid out.

A qualified profit-sharing plan is designed to Allow employees to participate in the profits of the company An individual working part time has an annual income of 25000. It allows you to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year. For a retirement plan to be qualified it must be designed for who benefit.

A profit-sharing plan is a type of defined contribution plan that allows companies to help their employees save for retirement. Cash or Deferred Arrangement CODA permits an employee to defer a portion of his salary on a pretax basis to a qualified plan or receive the salary as current taxable income. A qualified profit sharing plan that uses a combination of age and compensation as the basis for allocating the contribution to a participants account.

A qualified profit-sharing plan is designed to a. In general profit-sharing gives employees an explicit stake in a companys profits. It is up to the company to decide how much of its profits it wishes to share.

Distribute a portion of company earnings to its employees c. Employers use these plans to give their workers a stake in the companys success. It allows the employer to choose how much to contribute to the plan out of profits or otherwise each year including making no contribution for a year.

Allow employees to elect company officers. A qualified profit-sharing plan is designed to allow employees to participate in the profits of the company Which of the following is TRUE about a qualified retirement that is top heavy. The sponsor then makes its plan available for employers to adopt.

Question 2 5 5 pts If Brad begins receiving distributions from a profit sharing plan calculated over his life expectancy at the age of 28 the distributions will be subject to income tax but will not subject to the 10 penalty.

How Do College Savings Plans Compare Saving For College Savings Plan College Savings Plans

Lic S Jeevan Tarun Life Insurance Corporation Life Insurance For Children Life Insurance Marketing

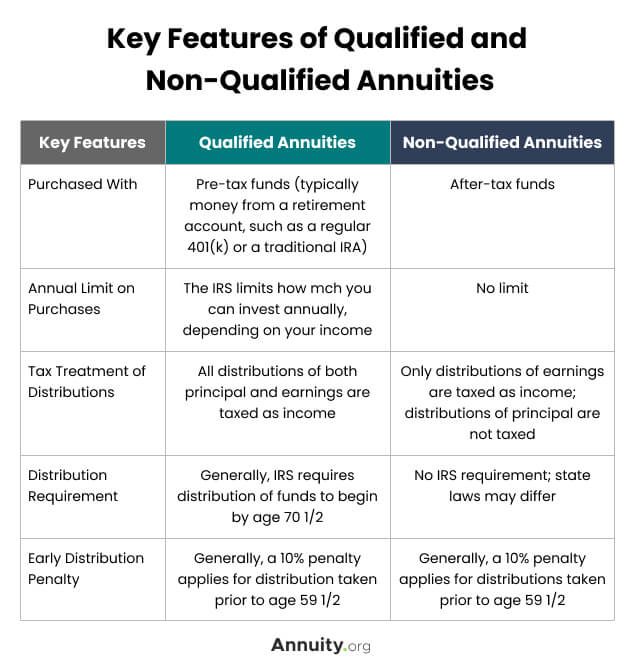

Qualified Vs Non Qualified Annuities Taxation And Distribution

Why Your Qualified Leads Refuse To Sign Up The Ux Of Plans And Pricing How To Plan Web Design Pricing Table

0 Comments